In its third attempt to inject life into the weak U.S. economy, the Federal Reserve revealed plans to initiative a third round of quantitative easing (QE3). The Fed intends to purchase $40 billion dollars in mortgage–backed-securities (MBSs) each month and has an open end date. This provides flexibility for the Fed to adjust its decision based on the response of the economy.

Beginning on Friday, the Fed will buy MBSs, which would equal a pro-rated amount of $23 billion for purchases made for the rest of the month.

Other Fed Polices

For the last four years, the Feds have tried other attempts to stimulate the economy. Along with this round of quantitative easing, the Fed already has in effect another monetary policy called “Operation Twist.” Operation Twist refers to the private bank’s decision to sell Treasuries or short-term debt that have maturity dates of three years or less, and replace them with the same amount of long-term securities with maturity dates of 6-30 years.

The QE programs (QE1 and QE2) and Operation Twist increased the Fed’s long-term bond portfolio by $85 billion a month.

The other tool the Federal Reserve has used to try and grow the economy consist of its policy to maintain short-term interest rates at “exceptionally low levels" through the second quarter in 2015. Short-term interest rates refer to the Fed Funds rate or the interest rate banks charge each other for overnight loans. Banks borrow these funds to ensure they meet statutory reserve requirements.

The Fed Funds rate has remained close to zero and has led to some of the lowest interest rates seen in this country.

Federal Reserve’s Goal

The Fed’s main objective with its monetary policies focuses on keeping interest rates low, especially home mortgage rates. In theory, low interest rates should boost spending by consumers and companies. Increase spending, particularly by consumers, who make of 70 percent of the domestic economy, should generate more jobs.

According to Commerce Department data, consumer spending increased 1.7 percent in the second quarter of 2012. It is the worse quarter for the key indicator since the third quarter of 2011.

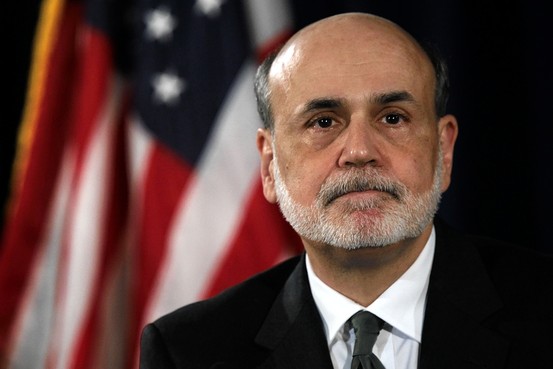

The unemployment rate represents a major concern for the Fed because it has remained above 8 percent for 44 consecutive months – the longest stint in U.S. history. The August job situation report released by the Labor Department showed a decrease in hiring. The employment report provided yet another signal the Fed needed to act at its September policy meeting. “The weak job market should concern every American. It imposes hardship on people and a waste of human skills and talents,” said the chairperson of the Federal Reserve Ben Bernanke months.

The Federal Reserve will closely monitor the economy’s response to QE3. It plans to use other monetary tools “if the "labor market does not improve substantially."

Bernanke went on to say, "I want to be clear -- While I think we can make a meaningful and significant contribution to reducing this problem, we can't solve it. We don't have tools that are strong enough to solve the unemployment problem."

Feedback on Fed’s Actions

Republican policymakers have been critical of the QE policies because they believe it expands the money supply and puts the country on course for a future of high inflation. Some market analysts do not expect additional stimulus to make much difference, in terms of fueling the economy, and say it’s difficult to ascertain QE policy risks.

Furthermore, economists credit the first and second round of quantitative easing with reducing interest rates to historic lows and helping to boost the equities market. However, banks have not used the infusion of capital to make loans. Instead, lenders have tightened credit underwriting criteria.

Wall Street investors had a positive response to the news that the Fed would invoke QE3, traders pushed stock prices higher. Some market watchers expressed disappointment with the size of the bond buying program at $40 billion per month. The Fed allotted $75 billion per month for QE2.

Nonetheless, Bernanke promised the Fed will increase spending to buy MBSs “if the outlook for the labor market does not improve substantially." In 2008, the Fed initiated QE1 in response to the recession and eventually brought $1.75 trillion in mortgage-backed-securities.